How to update or delete an EA in MT5?

How to Update or Delete an EA in MT5?

Intro: In the fast-moving world of automated trading, keeping your Expert Advisor fresh matters as much as your chart setup. You’re juggling multiple markets—from forex and stocks to crypto, indices, options, and commodities—while staying aligned with security, reliability, and performance. Updating or removing an EA in MT5 isn’t just housekeeping; it’s a way to preserve edge, reduce risk, and harness new tools as markets evolve.

Body

What updating an EA really involves

- An EA update goes beyond swapping a line of code. It means revisiting inputs, logic, and risk controls to match current liquidity, volatility, and broker quirks. You might adjust leverage assumptions, lot sizing, drawdown limits, or new trade filters to avoid whipsaws on volatile assets like crypto.

- You should recompile in MetaEditor and re-test. Even small tweaks can change behavior across forex pairs, stock CFDs, or commodities. Strategy testing lets you compare performance before you go live, especially when your EA runs across multiple asset classes.

- Documentation matters. Keep a changelog: version, what changed, why, and the expected impact on drawdown and win rate. It saves confusion if you’re collaborating or revisiting a strategy after a market shock.

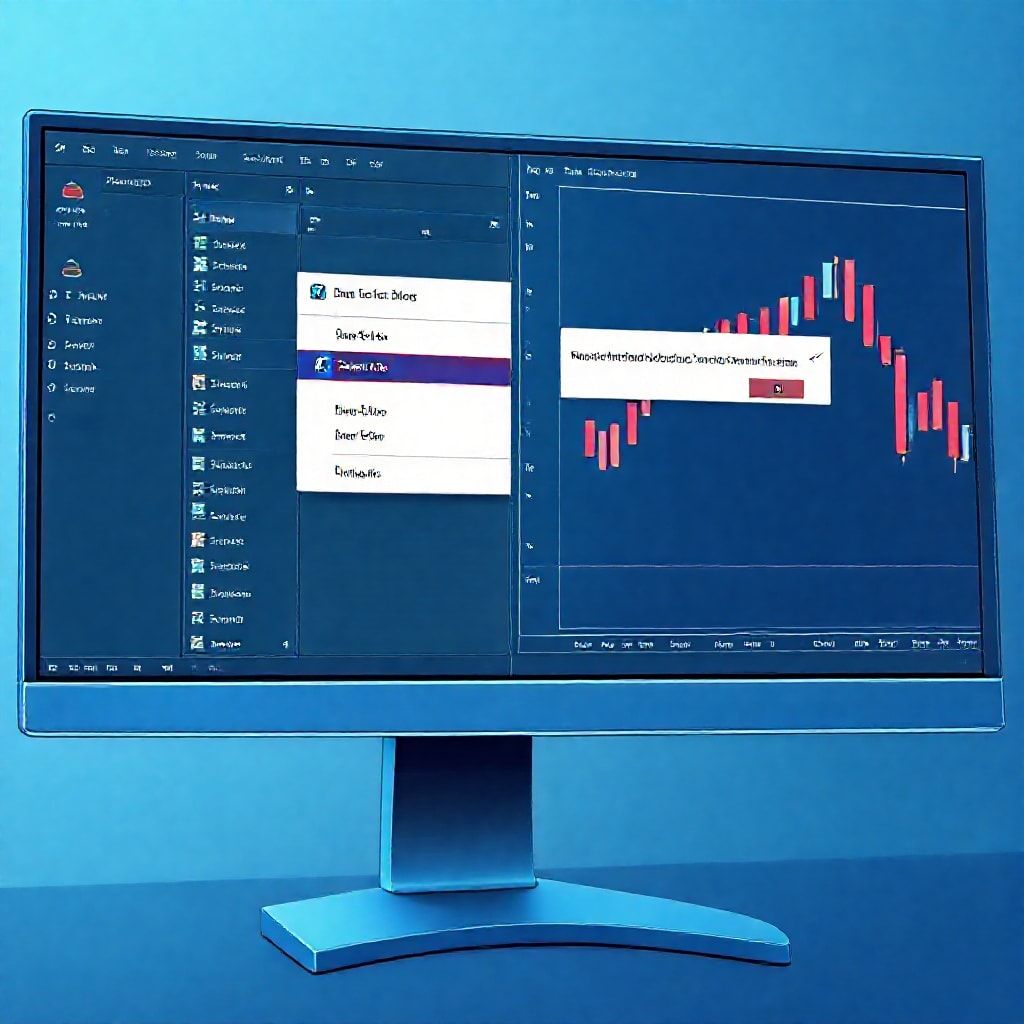

How to execute an update in MT5 (practical steps)

- Open MT5, head to the Navigator, and locate your EA under Expert Advisors. If you’ve edited the code, launch MetaEditor (F4) and open the EA file. Make your changes, then compile. Look for green “0 errors, 0 warnings” to ensure clean build.

- Tweak inputs on the EA’s settings panel (parameters like risk, stop loss, trailing stop, or time filters) without changing core logic. This lets you compare new inputs side-by-side with the old ones.

- Run a strategy test on representative assets—forex majors, a crypto CFD, and a stock index—to gauge how updates affect different markets. Use tick data or high-quality candles to stress-test during news events.

- Deploy on a demo or a controlled real account first. Pair the update with a careful monitoring plan so you catch any unexpected behavior early.

How to delete an EA in MT5 (clean removal)

- Remove from charts: right-click the chart, select Expert Advisors, and delete the EA from the current chart to stop new trades.

- Clean the file: in MT5, open the Data Folder, go to MQL5/Experts, and delete the EA file. Clear any associated templates or imported indicators if you won’t reuse them.

- Reclaim resources: restart MT5 to ensure caches reset, and verify there are no lingering auto-trading tasks. If you have a portfolio of EAs, audit each one to avoid duplicate risk or conflicting orders.

Why this matters in a web3, multi-asset world

- The web3 era expands trading beyond традиционал forex into stock, crypto, and commodities via digital assets and tokenized markets. EAs that adapt to cross-asset correlations help you capture spillovers and hedges, but they must be tested across different liquidity regimes and settlement times.

- Reliability comes from disciplined updates, robust backups, and a mix of automated checks with human oversight. It’s not just about speed; it’s about ensuring your automated strategy remains coherent when volatility spikes.

Pros and cautions, with leverage and risk notes

- Across forex, crypto, indices, and commodities, leverage magnifies both gains and losses. Use conservative starting settings when you deploy updated EAs, especially on gap-prone assets. Always test in a risk-lixed environment before going live.

- In terms of safety, back up your EA code and input profiles. Use MT5’s profile and clipboard backups, and consider a versioning habit so you can roll back if a fresh update underperforms.

Future-facing trends

- Decentralized finance and smart contracts are pushing broader automation, but the road isn’t smooth: off-chain oracles, custody, and regulatory compliance—these are ongoing hurdles. AI-driven tuning and on-chain signals may soon blend with MT5-style automation, offering smarter trade filters and optimization loops.

- The next wave emphasizes resilience: combined chart analysis tools, multi-asset correlation dashboards, and connected risk controls. The slogan to keep in mind: Update, verify, and edge-build your EA for a world where AI, smart contracts, and traditional platforms coexist.

Promotional note

- Stay ahead with a mindset that blends automation with due diligence: Update your EA to stay sharp, delete what’s not working, and keep your edge alive. Upgrade your EA, upgrade your edge. Your charts, your rules, your evolving edge.